Taxation of cryptomining in Germany (Update 05/2022)

Some of you will no doubt have already read the latest news on the taxation of cryptocurrencies, tokens, staking and mining.

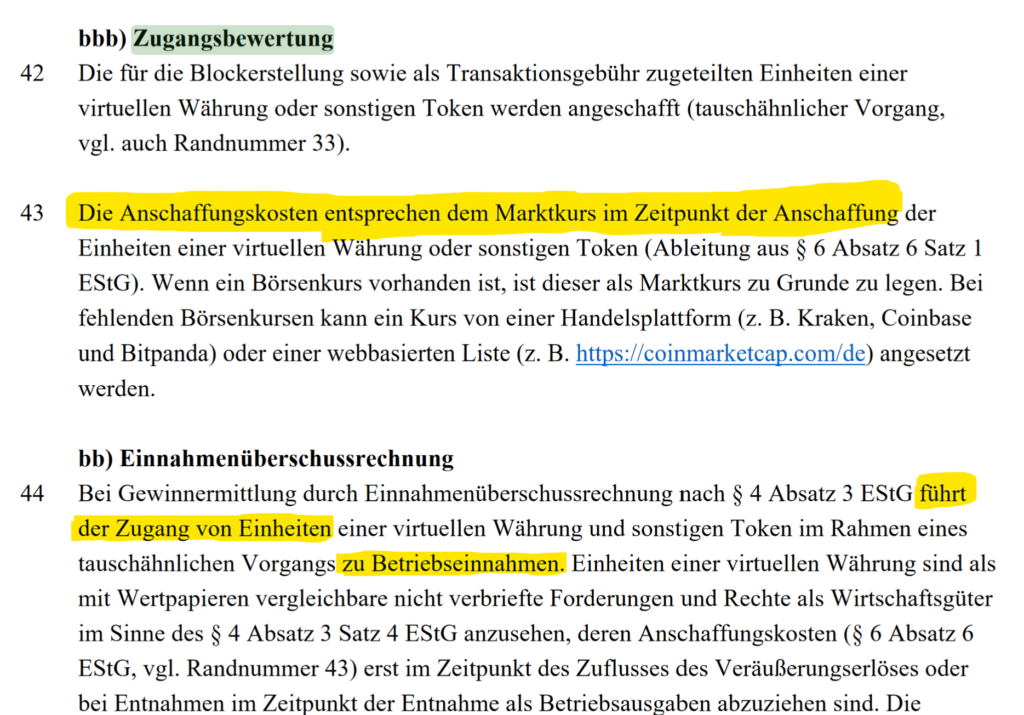

However, what most may not have noticed is the rather disadvantageous taxation of cryptomining. This is because the mined cryptocurrencies are not considered manufactured, but rather acquired. The mined cryptocurrencies must therefore be valued at the moment of acquisition as part of an acquisition valuation, just as if you were fictitiously buying the coins.

In simplified terms, this means: At the moment the mined coins flow to you (e.g. from the pool), you must book the coins as revenue at the current market value.

This regulation (EÜR) applies in principle to all tradesmen who are not required to keep a balance sheet, with an annual turnover of less than 600,000 euros and an annual profit of less than 60,000 euros.

You should notice the problem immediately: The crypto market is very volatile, which means that should the coins fall later, the higher taxes would still apply.

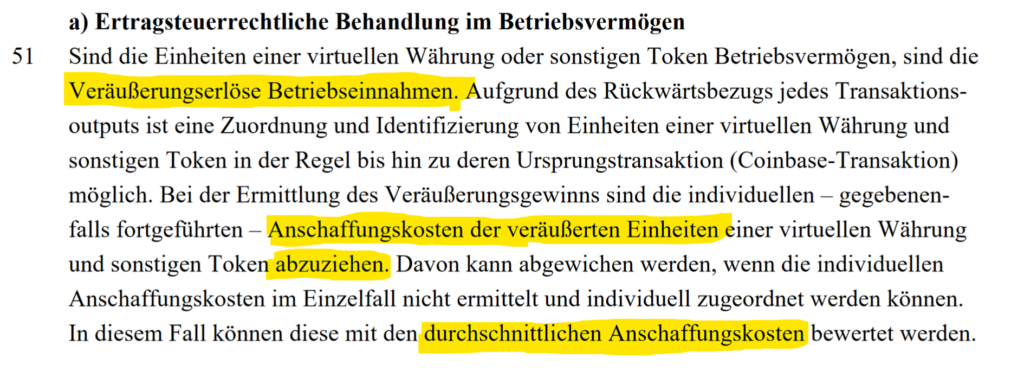

In the case of larger companies, there is a deviating increase in the business assets in the amount of the acquisition costs (see above) at the time of addition.

These acquisition costs can be deducted from the proceeds of sale when the virtual currencies are sold at a later date.

But here, too, the question arises as to how to deal with heavy exchange rate losses. On the face of it, there could be a loss on disposal here, which should have a positive effect again for tax purposes (on the taxes payable in respect of the remaining operating proceeds) at the time of sale.

In the event of a larger loss, there would presumably still be the option of carrying forward the loss. However, the main disadvantage should still be the taxes already paid, if any, on the previously increased business assets.

The full document can be downloaded here: